Fed rate hike

Web After Feds rate hike announcement past increases hint at how stock market will react Jim Sergent USA TODAY Published 903 am UTC Oct. The Feds move will mark the fourth.

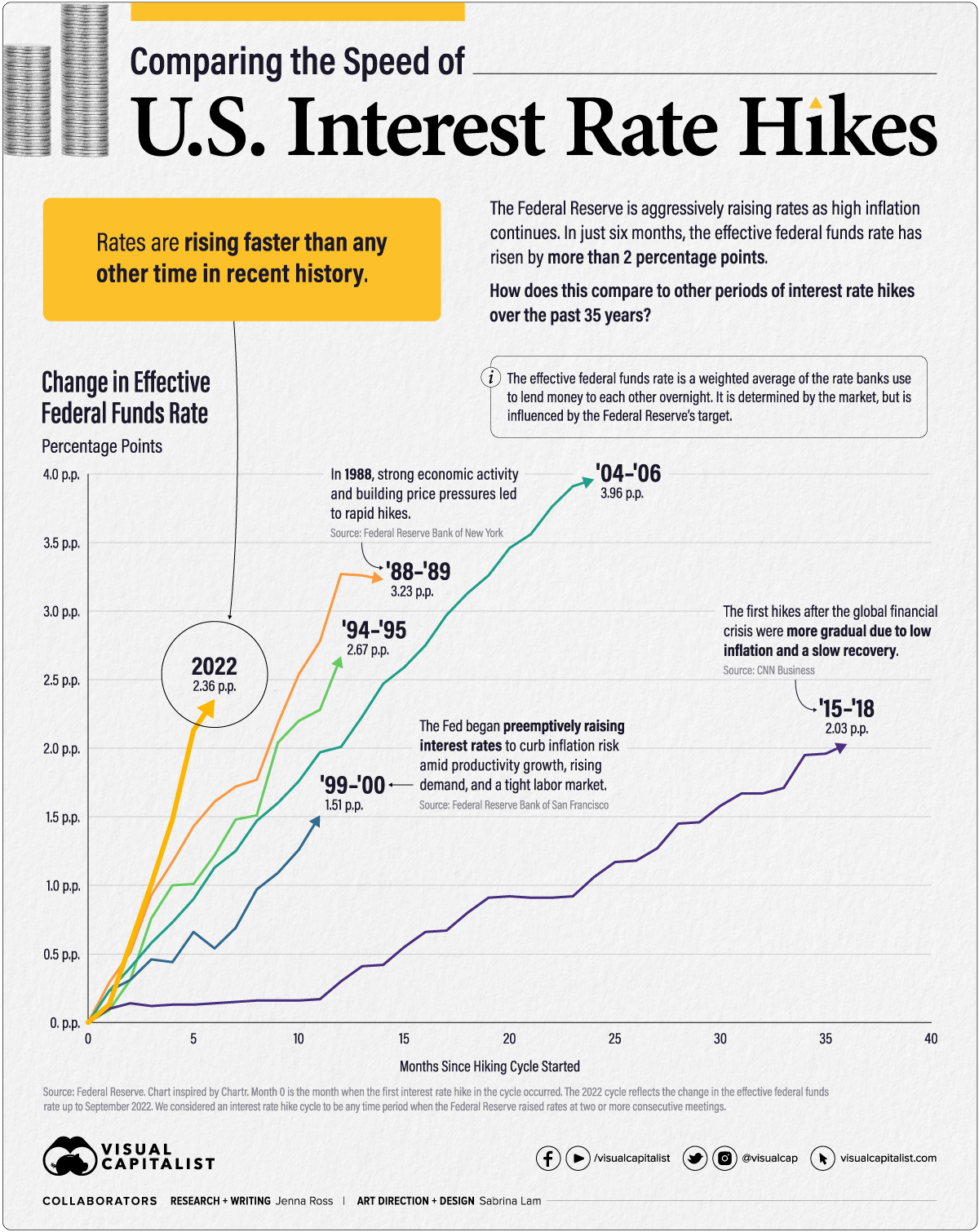

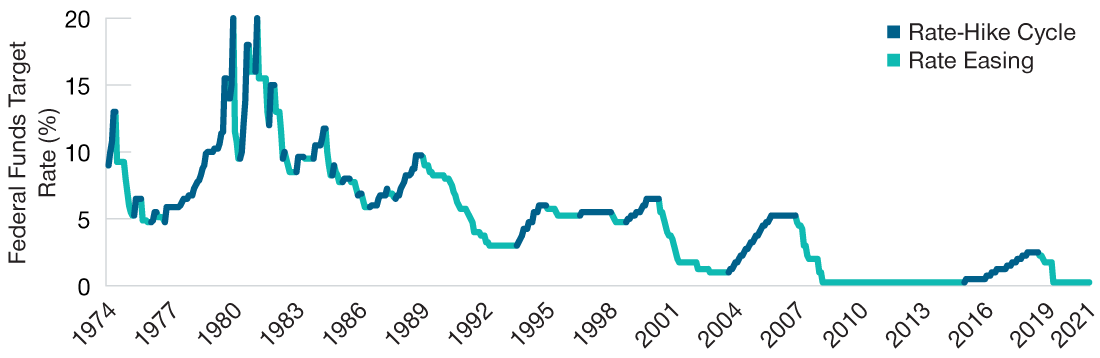

Comparing The Speed Of U S Interest Rate Hikes 1988 2022

Web The Federal Reserve on Wednesday approved the fourth straight jumbo interest-rate hike bringing its benchmark interest rate to the highest level in 15 years.

. Web The Federal Reserves last rate hike could come as soon as January but stocks will still be under pressure from dismal earnings into 2023 according to Morgan Stanley strategist Andrew Sheets. That implies a quarter-point rate rise next year but no. Web Nomura predicts the rate will be increased to a range of 325 to 35 at the Feds policy meeting this week and the Fed in Nomuras view will ultimately push that key rate as high as 475.

Central bank has. Web Asian shares climb on Fed rate-hike slowdown China stimulus MSCIs broadest index of Asia-Pacific shares outside Japan rose 08 in early trade while the Nikkei surged 13 24 November 2022. But what happens after the next Fed rate hike.

Market participants desperately. Heading into the November meeting the Fed is eying a federal funds rate of 4. Web Following the Feds September hike the stock market dropped 17 as the federal funds rate hit the 3 threshold.

By a unanimous vote the Fed. Web The Fed raised its benchmark rate by 075 percentage point in both June and July the largest back-to-back increases since the central bank started using the funds rate as its chief monetary. Web The Fed lifted its Fed Funds rate by 75 basis points matching the biggest move since 1994 to a range of 375 to 4 the highest since 2008 and said near-term rate moves would be needed in.

Recession fears rise as Fed eyes another interest rate hike. Web Fed delivers 075-point rate hike signals possible smaller increases ahead. Web As of March 1 2016 the daily effective federal funds rate EFFR is a volume-weighted median of transaction-level data collected from depository institutions in the Report of Selected Money Market Rates FR 2420.

The Feds benchmark rate. Web The Federal Reserve Board of Governors in Washington DC. That is as high as rates have been.

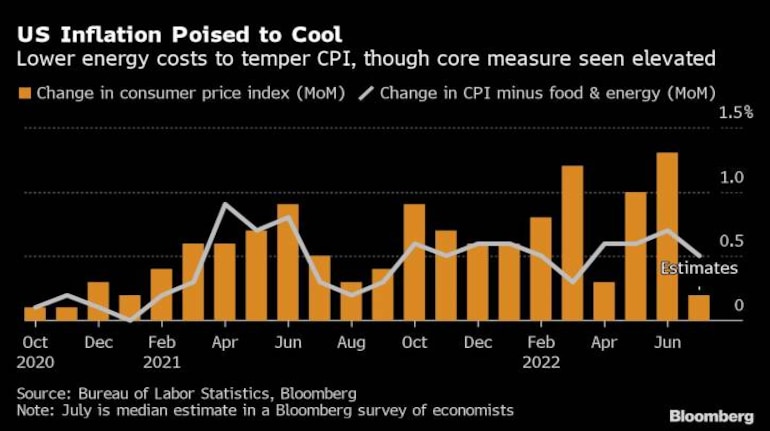

31 2022 Updated 1022 am UTC Nov. Inflation data and a. Web The US Federal Reserve announced a 75 basis points bps rate hike in its FOMC meeting held on September 21.

Inflation Consumer inflation in Tokyo rises at fastest pace in 40 years. Web The Federal Reserve raised the target federal funds rate by 075 percentage point for the fourth time in a row on Wednesday marking an unprecedented pace of rate hikes. Web Debt-loaded cruise lines shares fall as Fed hikes rate and recession fears grow Published Fri Sep 23 2022 1221 PM EDT Updated Fri Sep 23 2022 120 PM EDT Jack Stebbins jackstebbs.

Web Treasury yields were mostly higher with the two-year note the most sensitive to Fed rate hikes rising by nearly five basis points to 349. Bringing the Fed-funds rate target range to 375 to 400. A basis point equals 001 percentage point.

It was the central banks sixth rate hike this year a streak that has made mortgages and other consumer and business loans increasingly expensive and heightened the risk of a recession. Web The Feds move raised its key short-term rate to a range of 375 percent to 4 percent its highest level in 15 years. Web The Federal Reserve is widely expected to deliver a fourth consecutive rate increase of 075 Wednesday afternoon.

Web Gold miners are tallying strong gains in Thursdays trading as gold futures pushed past 1800oz for the first time since mid-August following milder than expected US. Prior to March 1 2016 the EFFR was a volume-weighted mean of rates on brokered trades. Web Federal Reserve Chairman Jerome Powell announced that the Fed will hike interest rates by 075 points on November 2 2022.

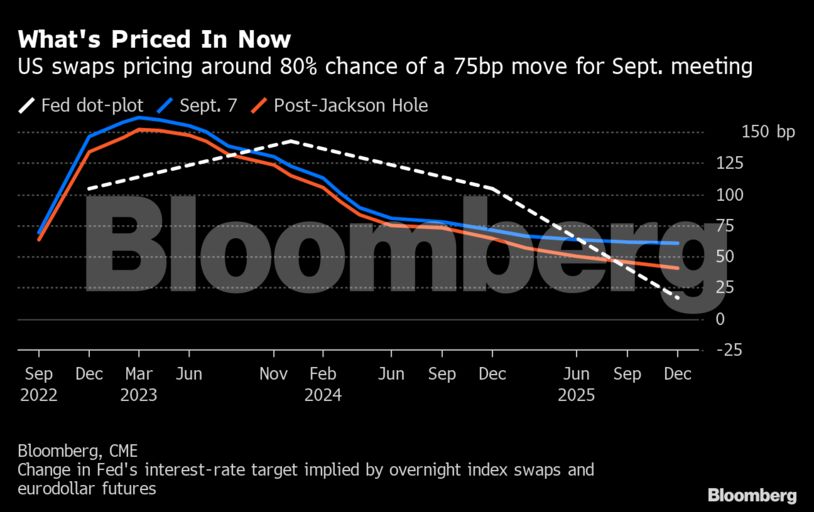

Web Fed officials signaled the intention of continuing to hike until the funds level hits a terminal rate or end point of 46 in 2023. Web A strong majority of economists 44 of 72 predicted the central bank would hike its fed funds rate by 75 basis points next week after two such moves in June and July compared to only 20 who. Board of Governors of the Federal Reserve System The Federal Reserve the central bank of the United States provides the nation with a safe flexible and stable monetary and financial system.

Web It is the central banks sixth rate hike of 2022 and fourth straight 075 percentage-point bump. Web The rate hike brings the federal funds rate to a targeted range of 3 to 325 and the Fed said it anticipates that more rate hikes are on the horizon as it is strongly committed to returning. Web Analysts and economists are confident the Fed will hike its baseline interest rate range by another 075 percentage points at the end of a Wednesday meeting.

The dot plot showed Fed officials expected rates to rise to 44 in 2022 and 46 next. Web Market expectations are running high that policymakers will approve another rate hike but this time opting for a 05 percentage point or 50 basis point move.

S Ds On Expected Interest Rates Hike We Must Avoid Mistakes Of The Past And Protect The Most Vulnerable Europeans Socialists Democrats

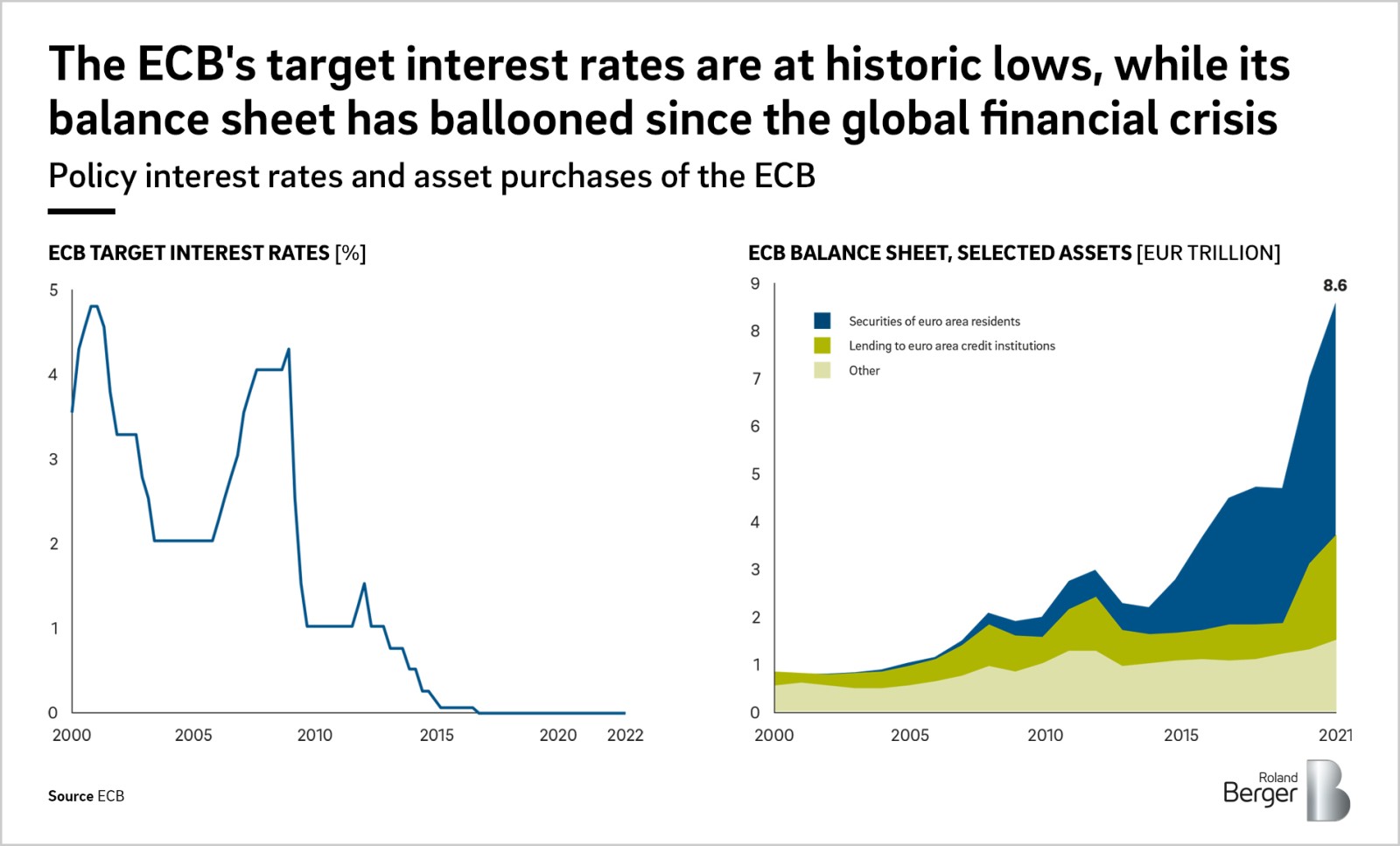

What If The Ecb Raises The Key Interest Rates Roland Berger

Federal Reserve Approves Its Third Rate Hike Of The Year

About Those Fed Rate Hikes They Might Take Longer Than You Think Chief Investment Officer

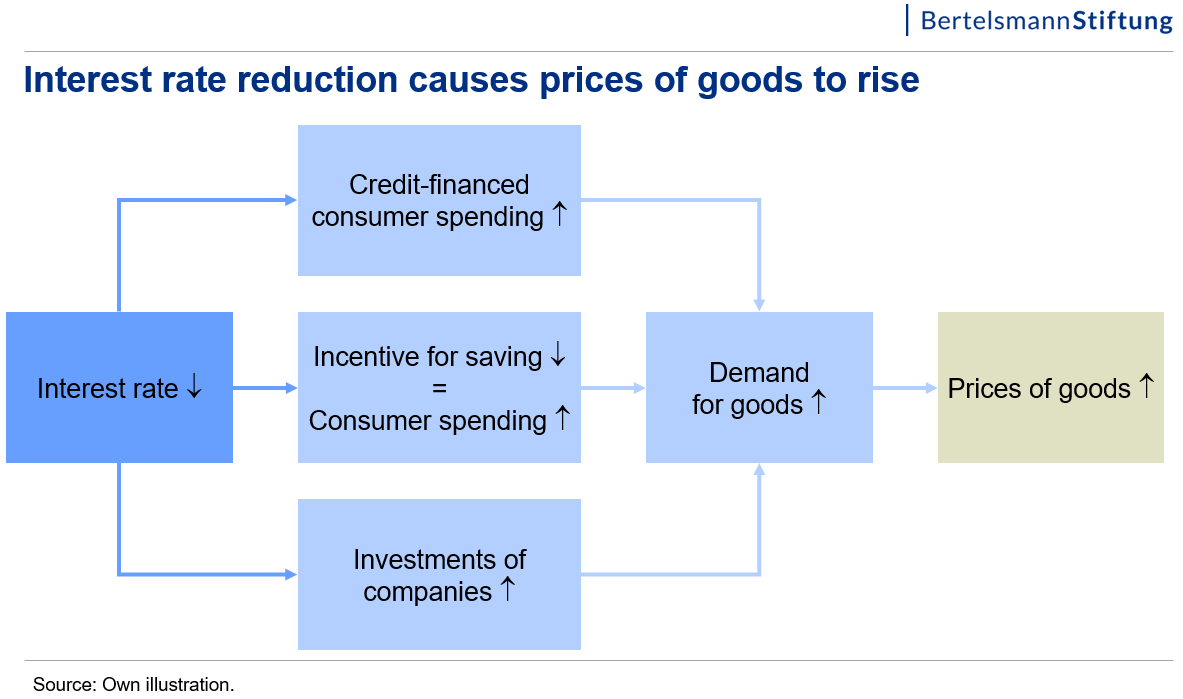

Interest Rate Hike By The Fed What Does It Mean For Europe

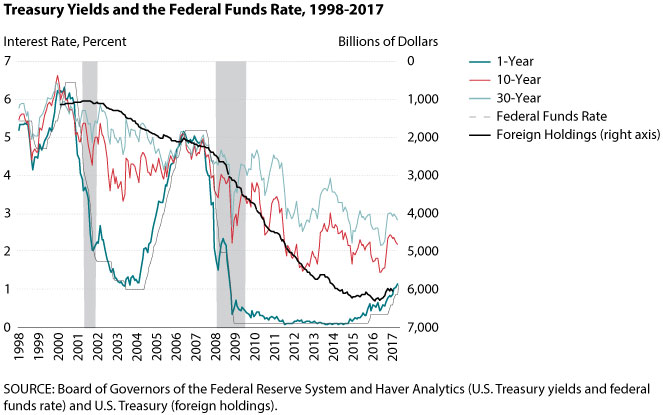

The Rising Federal Funds Rate In The Current Low Long Term Interest Rate Environment St Louis Fed

Fed Raises Interest Rates Keeps Forecast For 3 Hikes In 2018

How Fed S New Interest Rate Hike Affects Inflation And You Money

Putting The Fed S Planned Rate Hikes Into Context T Rowe Price

Here Is Why A 0 75 Fed Rate Hike Could Be Bullish For Bitcoin And Altcoins

Ud4laowe1j9e3m

On The Money Bracing For Another Fed Rate Hike The Hill

Respite In Us Inflation Unlikely To Derail Fed Rate Hike Plans

How The Fed S September Interest Rate Hike Will Affect You Money

10 Year Yields Highest Since 2011 Before Expected Fed Rate Hike

Fed Rate Hike Fed Traders Steer Toward A 75 Basis Point September Rate Hike The Economic Times

Market Expectations Grow For Early Fed Rate Hike As Inflation Rises S P Global Market Intelligence